Let Freedom Tweet!

Invest Like A Farmer is an investing blog by T. H. RAPKO AND COMPANY, LLC’s managing member Thomas H. Rapko focused on macroeconomics. It presents Tom’s insights and thoughts on the markets. Although the author expresses a view on the likely future performance of certain investment instruments, each individual should carefully consider his or her investment position in relation to his or her own circumstances and with the benefit of professional advice prior to making any investment decisions.

Monday, April 25, 2022

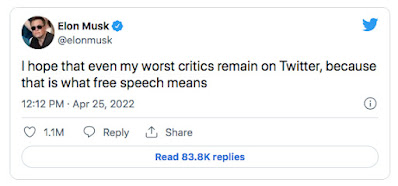

Let Freedom Tweet!

Sunday, April 24, 2022

DCA Primetime

DCA Primetime

Monday, April 18, 2022

Civic Duty

Civic Duty

Friday, April 15, 2022

Half Pay All

Half Pay All

Monday, April 11, 2022

Splitsville

Splitsville

How does a stock split typically affect stock performance? It depends. In principle, a stock split does not add any intrinsic value. A stock split simply increases the number of existing shares while simultaneously reducing the corresponding price point. So on the surface a stock split is a neutral event at best. So why would a company bother?

There are several important reasons to consider doing a stock split, some are purely aesthetic while others have significant value. First, from an aesthetic standpoint who doesn't like having MORE of something? Shareholders generally like the idea of having MORE shares. High flying stock prices make significant share volume purchases pricey, so companies feel that increasing the number of shares via a split will attract a larger base of potential investors (similar to the pricing of IPOs...rarely, if ever, do you see an IPO issue in the hundred dollar plus column; issuers want to generate enthusiasm for a deal by pricing MANY shares in the teens rather then far few shares in the hundreds of dollars.)

A second aesthetic reason for splitting a stock is to smooth the chart. Stocks that have literally gone through the roof have a parabolic chart that often suspiciously looks like it will collapse. Hence, we see splits to help smooth this 3, 5, 10-year chart to something approximating a ramp rather than a rocket ship launch.

The third aesthetic reason, but also a practical one, is the ability with greater volume of stock to better hedge positions via Covered Calls or Puts. Contracts are traded in 100 share units, thus for several big tech companies an investor would have to own several hundred thousand dollars worth of the stock just to have enough shares for a single options contract.

Aesthetic reasons aside, several large tech companies have announced share splits that will effectively transform their shares from several thousand dollars each into several hundred dollars each. Why does this matter? Potential inclusion into the Dow Jones Industrial Average hinges on share price rather than market cap. Currently three large tech companies come to mind that are NOT included in the DJIA. Significant splits make the eligible.

In summary, stocks split for many reasons. It has often been a litmus test of a company's success as to whether they do split or not. One of my favorite websites is: www.stocksplithistory.com

Here a financial farmer can input a ticker symbol and get the historical stock split history of a company, resulting shares, and it also provides recent 10-year data of the hypothetical $10K invested in a company. Great financial tool!

Friday, April 1, 2022

April's Fool

April's Fool