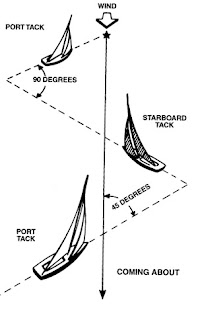

Tacking

Invest Like A Farmer is an investing blog by T. H. RAPKO AND COMPANY, LLC’s managing member Thomas H. Rapko focused on macroeconomics. It presents Tom’s insights and thoughts on the markets. Although the author expresses a view on the likely future performance of certain investment instruments, each individual should carefully consider his or her investment position in relation to his or her own circumstances and with the benefit of professional advice prior to making any investment decisions.

Tuesday, June 28, 2022

Tacking

Monday, June 27, 2022

Demand Shock

Demand Shock

Tuesday, June 21, 2022

Sneaker Waves

Sneaker Waves

Thursday, June 16, 2022

Investment Code

Investment Code

Wednesday, June 15, 2022

Wite-Out

Wite-Out

Today millions of American citizens will dutifully write checks to the IRS, State, and Local governments for billions of their hard-earned dollars. But this quarter their "fair share" will be lower, low enough to warrant a bottle of Wite-Out on the quarterly vouchers. Income destruction has been wrought upon you by politicians who know only a W-2 and an endless gravy train. Free Healthcare. Fat Pensions. Largess.

On this hallowed day, it is worthwhile to recount the introduction to our Declaration of Independence:

"When in the Course of human events, it becomes necessary for one people to dissolve the political bands which have connected them with another, and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation."

"We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed. That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. Prudence, indeed, will dictate that Governments long established should not be changed for light and transient causes; and accordingly all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed. But when a long train of abuses and usurpations, pursing invariably the same Object evinces a design to reduct them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security. Such has been the patient sufferance of these Colonies; and such is now the necessity which constrains them to alter their former Systems of Government. The history of the present King of Great Britain is a history of repeated injuries and usurpations, all having in direct object the establishment of an absolute Tyranny over the States."

Do you ever feel like you're getting the taxation without the representation? Did you instruct your Congressman to abolish our borders? Did you tell the same "leader" that you want to rely on foreign oil and supply chains for your well-being? Is your "fair share" tossed atop government coffers overflowing with taxpayer remittences...waiting to be squandered on programs and services that benefit only the denizens of corruption? How is your "pursuit of Happiness" going these days?

Tuesday, June 14, 2022

More Cowbell

More Cowbell

Monday, June 13, 2022

Tasty Tidbits

Tasty Tidbits

Sunday, June 12, 2022

Suffering Fools

Suffering Fools

Monday, June 6, 2022

Absolute Alpha

Absolute Alpha