Shearing Sheeple

Invest Like A Farmer is an investing blog by T. H. RAPKO AND COMPANY, LLC’s managing member Thomas H. Rapko focused on macroeconomics. It presents Tom’s insights and thoughts on the markets. Although the author expresses a view on the likely future performance of certain investment instruments, each individual should carefully consider his or her investment position in relation to his or her own circumstances and with the benefit of professional advice prior to making any investment decisions.

Friday, December 30, 2022

Shearing Sheeple

Thursday, December 8, 2022

Speed Brake

Speed Brake

Wednesday, December 7, 2022

Zero Legitimacy

Zero Legitimacy

Monday, December 5, 2022

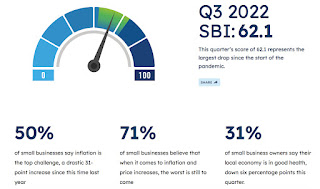

The War on Small Business

The War on Small Business

Sunday, November 27, 2022

Layoff Guru

Layoff Guru

Monday, November 21, 2022

Tech Layoffs

Tech Layoffs

Thursday, November 17, 2022

Too Big To Innovate

Too Big To Innovate

With tens of thousands of layoffs pending, Silicon Valley has proven it is "Too Big To Innovate." The bloated employment roles of many major tech companies for years have been a symptom of a dearth of innovation; many hires were made simply to prevent those people from actually creating competition. The "I-Word," innovation, is the worst word in the lexicon amongst the "Big Five" in Silicon Valley.

Google owns search. Apple owns iPhone. Facebook owns social. Amazon owns e-commerce. Microsoft owns bad software. Sprinkled in those distinct monopolies are a mix of other "bets" which help assuage regulators. But make no mistake dear readers, when times get tough (and your stock is down say 50%+ year-to-date), it is time to cull those losing hands and focus on what works: monopolistic control of niche segments and layoffs. And nothing hits the bottom line faster than fewer employees.

Sadly the new aphorism for non-founder CEOs seems to be the same: "When in doubt, Grinch it out."

The net beneficiaries? Oddly enough, culling large numbers of employees ramp up production of digital nicotine. Layoffs will have wondrous effects on the bottom lines of these companies. After the one-time costs associated with severance, a couple months salary and limited healthcare, those employees are now off the books and largely become subsidized by taxpayers for healthcare. And the companies themselves? Oh baby, get out the napkins because it is gravy train time!

Each percentage of layoffs translates to an exponential increase in bottom line profitability for these tech companies. Workloads are typically transferred to surviving employees, or if the worker was not a revenue producer, that functionality may cease to exist. It is not a 1:1 benefit ratio to the company.

Obviously the damage is most acute in regards to future products development, but when you own a tech monopoly R&D becomes an increasingly negligible cost. The only real danger to the "Big Five" is that maybe some of these employees become founders.

Friday, October 21, 2022

Venmo Fraud

Venmo Fraud

Tuesday, September 27, 2022

Crash Landing

Crash Landing

Friday, September 16, 2022

Moon Dollars

Moon Dollars

Thursday, September 15, 2022

Ode to the Taxpayer

Ode to the Taxpayer

Saturday, September 3, 2022

Stagflation

Stagflation

Tuesday, August 30, 2022

Winter is Coming

Winter is Coming

Wednesday, August 24, 2022

Inflation Production Act

Inflation Production Act

Saturday, August 20, 2022

Leaky Cauldrons

Leaky Cauldrons

Wednesday, August 10, 2022

Banana Republic

Banana Republic

Thursday, August 4, 2022

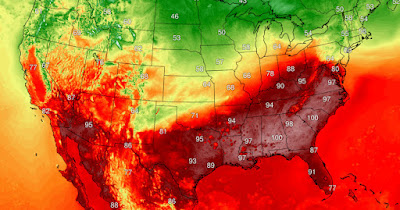

Heat Waves

Heat Waves

Friday, July 29, 2022

Tax & Spend

Tax & Spend

Saturday, July 23, 2022

ACA Gravy Train

ACA Gravy Train

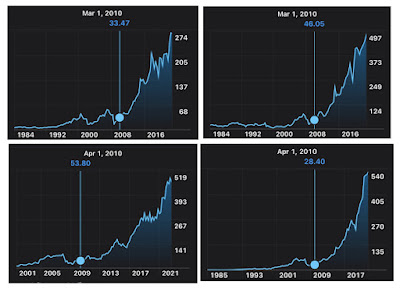

In the annuals of history, there has naught been a bigger Gravy Train than the passing of the "Affordable Care Act" on March 23rd, 2010. It is a day that will live in infamy. Imbued with the power of nation-states by the Sun King Barrack Hussein Obama, health insurers were granted pass-through monopolies.

Consider the charts above of the four largest remaining publicly traded health insurance companies. Almost to the day of ACA passage there has been a meteoric rise in their respective share prices. How is this possible? Amazing care? Deft management? Sweeping reform? Oh no dear readers, these companies have the implicit power to charge whatever the market will bear...and if you can't afford it, the government will pay your premium, but if you can afford it and DO NOT pay, then you can go to jail (the government of course determines "affordability.") Got that?

So while Chicago burns this summer (both figuratively and literally), its most famous son, who vowed that "the South Side of Chicago is my Martha's Vineyard," is inking yet another lucrative media deal at his estate in...Martha's Vineyard.

The hypocrisy is as thick as our vast oil reserves that can't be pumped. In terms of corruption and maleficence perpetrated on the American people, the ACA ranks high. Consider the fallacy of mandating purchases, at any price, from private companies with geographic monopolies, of a product you may or may not use, but you are required to buy less face the loss of your freedom. Preposterous.

If there's one thing we've learned at ILAF though, crazy pays. Consider all the innovation in the tech space over the past decade. Or in EVs. Or in just about EVERY industry. The only thing healthcare seems to have innovated is consolidation, increased premiums, and higher share prices. Now that dear readers is true innovation!