Bear Market Playbook

Surviving a Bear Market ain't easy. Obviously the first thing you lose is proper grammar, mainly do to shock of the financial mauling you're getting in the market. First, keep calm. It is highly unlikely you can outrun a bear. The goal here is survival. We're where we're at for a conflux of reasons, none of them good. Now the question is, "How do I position my portfolio to survive, no THRIVE in a Bear Market?"

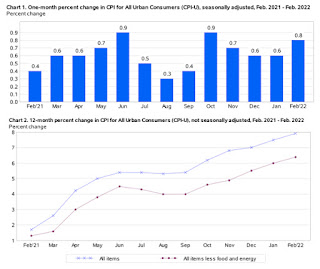

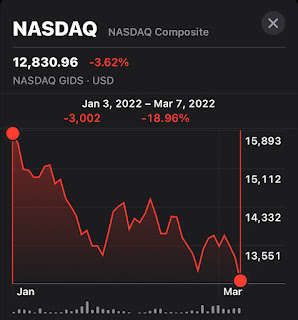

The first step is to understand what a Bear Market is. It is a historical "rule of thumb" for the past several hundred years which denotes the fall in valuation of roughly 20% off the highs of an index. I'm using the NASDAQ index as my benchmark. The high was 16,212 in Nov 21 and the low (so far) was 12,588 which we plumbed last week. This indicates we are some 22% off the record high and in a Bear Market.

More than just a percentage, a Bear Market also has some very, very "special" traits; ie it feels like you are getting mauled because, well you're getting mauled. Massive volatility spikes cause precipitous price declines (below what we think is even possible), which are often followed by sharp spikes the following day. Only to be succeeded by plunges the following day. And around and around the wheel turns until there is a day or period of capitulation in which the bear has taken everything he wants from you and departs for his cave.

The journey to the cave typically takes about 289 days on average. That's a long time. In that journey back to the cave there are multiple head-fakes, sniffing, foraging trips, digging, biting, and other general uncivilized acts of behavior. Timing the bottom is almost impossible. What is possible is security selection, discretion, and allocation. Investors need to decide if they plan on staying in the game or not, and if so what is a tolerable near-term loss. Booking a loss is painful, but not booking a loss is often worse.

So to playbook this out, figure out what type of loss is tolerable in the near-term. They say your first loss is your best loss, so with that in mind sketch out several "pain bands" and stick to them. After the bear rolls through, along with tons of carnage, there also remain good companies which have been beaten up. You have even previously owned them! Take a look around and start rebuilding slowly, and for God's sake please, please avoid the

wash sale rule; don't sell a security and then buy it back within a 30-day window. As an American still kinda free, you have a right to minimize your taxes....part of this means don't get whacked for wash sales.

One of my previous posts dealt with the value of education. Reread that. A solid education often results in a solid job with a corresponding good income. A good income allows you to buy stocks, real estate, companies, etc. etc. during bad times. And a LOT of money can be made in the bad times. Indeed, it is often said "the profit is made in the purchase." That is the true value to an investor that a Bear Market provides; the ability to pick up good brands, companies, and cash flow on the cheap. In fact, a strategy of ONLY buying in Bear Markets is commonly used by investors I term "Mountain Men."

Mountain Men are like the sasquatch, they are only rumored to exist. Typically you don't hear from them for long periods of time until there is a crisis of some sort. Then they spring into action. The Mountain Men come down from the mountain, or in from the jungle or away from the beach with bags of money. These bags of money are then used to purchase quality stocks on the absurdly cheap prices of a fraction of their true book value or growth prospects or leadership value.

The point here is that you need a list, a bag full of money, and the structure in place to buy. We can all have a list. If we have a decent job and live (somewhat) frugally then we can use excess cash to purchase more assets. The structure of course is your brokerage account or retirement account or 401K or personal balance sheet.

Eventually a Bear Market turns into a Bull Market. And those Bear prices rise to Bull levels. And investors who had excess liquid capital available stand to make a killing if their list was good and there cash was deployed correctly.