Bread and Circuses

Invest Like A Farmer is an investing blog by T. H. RAPKO AND COMPANY, LLC’s managing member Thomas H. Rapko focused on macroeconomics. It presents Tom’s insights and thoughts on the markets. Although the author expresses a view on the likely future performance of certain investment instruments, each individual should carefully consider his or her investment position in relation to his or her own circumstances and with the benefit of professional advice prior to making any investment decisions.

Sunday, January 30, 2022

Bread and Circuses

Friday, January 28, 2022

Why Education Matters

Why Education Matters

Thursday, January 27, 2022

Getting Breyer'd

Getting Breyer'd

Wednesday, January 26, 2022

Fed Watch

Fed Watch

Tuesday, January 25, 2022

Killing Them Softly

Killing Them Softly

Friday, January 21, 2022

Mean Reversion

Mean Reversion

Jeremy Grantham believes we are in the fourth superbubble of the last hundred years. He has many valid points and raises the specter of an utterly dismal 2022. Already we are down the first 3 weeks of January, and history shows that with almost certainty a down January results in a down year (.732 batting average.) With a handful of exceptions, notably massive Federal Reserve bailouts, this has always been the case. Grantham, however, takes it one step further than rule-of-thumb Wall Street adages and formulates a thesis on the simple premise of mean reversion.

Mean reversion describes just what it implies; that there will be a return to the average growth rate over time. Yes the growth rate itself might change over time, but sustainment of extremely high deviations from this average are difficult, if not impossible, to maintain over longer and longer periods of time. Typically they come in "bursts" that spike up (or down) in sharp, unstained points. Consider one of the best baseball batters in history, Ted Williams.

With a lifetime batting average of .344, Williams is arguably the best batter of all-time. He finished his career as the last batter with OVER a .400 average...that was almost a 20% deviation from his mean. Over long-enough careers with enough data players can be predictable, hence the rise of the current "Moneyball" climate of assembling a team on pure statistics. The stock market has even more statistics and a greater database to glean from for investors than baseball.

Consider the chart below, which identified 3 of the last 4 superbubbles and makes a prediction for the current situation:

Thursday, January 20, 2022

Crimea 2.0

Crimea 2.0

Wednesday, January 19, 2022

Branding Power

Branding Power

Thursday, January 13, 2022

The Great Resignation

The Great Resignation

Wednesday, January 12, 2022

Poopmetrics

Poopmetrics

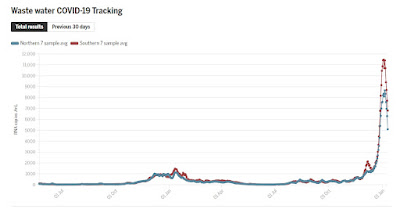

If the politicians can't be trusted, then what can citizens rely upon to tell them the Covid truth? Why fecal matter of course! Aptly titled "Poopmetrics" this article deals with the increasingly useful, accurate, and utility of measuring fecal matter in wastewater as both a snapshot AND predictive model of the NIH-funded gain-of-function research that lead to the release of Covid-19 from the Wuhan Institute of Virology in 2019.

This raw data gleaned from sewerage is probably one of, if not THE signature scientific advancement, outside the vaccines and therapeutics we have made since the start of the pandemic. It is scientifically sound. It is available at scale. And unless the politicians can corrupt the data flow, it should remain an enduring metric of the current infection pool, its delta (meaning change, in the classical Greek reference), and projected impact across geography in the United States. Obviously it is also scalable from a global perspective. Smoking Gun Alert: Is there a Wuhan dataset available from June 2019-December 2019?

Fecal analysis is about a pure a statistic as inflation and taxation in terms of portability to utility in terms of baseline establishment and predictive value. We can shift resources. Implement different treatments. And hopefully save lives!

From a financial perspective this collapse we see in Omicron in Boston sewerage after a hyper spike is extremely bullish; is this the third and final wave of Covid-19 that will then dissipate into the Spring? That chart sure looks good. Also encouraging is the relatively LOWER negative outcomes as a percentage of infections and hospitalizations. With over 75% of the population vaccinated and with a large percentage of the total population already exposed, recovering, or recovered from having had Covid-19 it seems that we are finally turning the corner on a pandemic which has raged for nearly 3 years.

Takeaways? In life and investing, look for raw, unadulterated visual data. We are a visual species. Politicians lie, but visual data accurately displayed tells its own story without spin. Stack these visual data sources and generate your own conclusion based on facts, reason, and probability. Then make your move.

Tuesday, January 11, 2022

ARKK Barometer

ARKK Barometer

Monday, January 10, 2022

Bad Omens

Bad Omens

Sunday, January 9, 2022

Omicron Surge

Omicron Surge