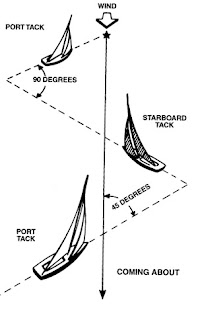

Tacking

Tacking allows a sailboat to indirectly sail to a desired waypoint against the wind; investors should take note of this timeless method of sailing. In many ways investors are also often fighting a wind on the way to their waypoint, but in their case the "wind" is a confluence of macro economic events and that waypoint is a financial goal(s).

Although no sailboat can sail against the wind, almost every sailor can tack in a zig zag pattern to reach their waypoint. The Absolute Alpha strategy was developed with this goal in mind, to harness ANY wind to reach a waypoint. Tacking of course is highly dependent on positioning the sails, but it is also a self-correcting mechanical maneuver which will quickly indicate if you're on a bad wind.

Investor need to consider not only their financial waypoint(s), but also the method in which they arrive. It is often said that life is "about the journey, not the destination." While that may largely be true, a destination of effervescent passive cash flow sounds quite lovely indeed...and the journey is the means of reaching that destination.

As previously posted in Sneaker Waves, it is extremely difficult to get to get where you want in a reasonable amount of time without having to deploy the lifeboats occasionally being long-only. Investors need to seriously consider an approach that is all-weather capable of tacking.

As always, it is important to look before you leap. What are the downsides to a tacking strategy? I believe the primary risk is signal risk. What signals will you use? How accurate are they? Are they dependable and repeatable? The secondary risk is the efficiency of using a strategy that may or may not trade frequently.

It has been knocked into our collective consciousness that frequent trading is a recipe for disaster. That is actually debatable...as Ray Dalio (amongst many others) is quoted as saying "Timing is everything." If the signals are good and the tacks made accordingly, then trading more is actually far, far more advantageous.

Consider dear readers the investor who tacked successfully this year. Would she be down on par with the S&P 500 some 20%? I think not. Assuming successful signal utilization, she would have been short for most of the year and also most likely tacking into several Bull spikes.

Tacking requires accurate signals and trust in the proverbial "wind" that is pushing all of our sailboats around...a waypoint is nearly impossible to reach fighting against the wind. Since we're on the water today, my friend Bruce Lee had an excellent analogy about water that is applicable I think to investing as well. It highlights the importance of harnessing signals and changing a position accordingly. If your sailboat needs help tacking, consider throwing us a line.

"Empty your mind, be formless, shapeless like water

put water into a cup, it becomes the cup;

you put water into a bottle, it becomes the bottle;

you put it in a teapot, it becomes the teapot.

Now water can flow or it can crash.

Be water my friend."