Ghosting Pareto

Ghosting Pareto is like trying to avoid gravity. Yet, this is exactly what investors should do. Why suffer the proverbial "slings and arrows of outrageous fortune" shot by Big Finance when alternative strategies exist?

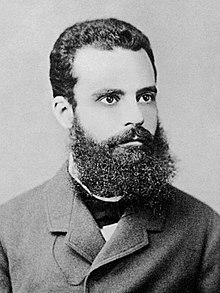

Vilfredo Pareto is best remembered as an economist of the namesake "Pareto Principle" which is a economic, social, and mathematical rule of thumb commonly referred to as the "80/20 Principle" or the "80/20 Rule." It is the recognition and codification of a naturally occurring phenomenon in life which he learned occurred in nearly every facet of life; whether it be income distribution, height, or even touchdowns thrown.

Investors should be concerned with Pareto because he helps us, indeed reveals, that the market for the most part is bullish over time. There are, however, vicious downturns that roll through the economy like sneaker waves every 4-5 years aptly termed Bear Markets.

Big Finance (kinda like Big Tobacco, but more dangerous) continually pitches "buy-and-hold," "weather it out,' and "dollar cost average." Are these bad strategies? Not necessarily, but investors rarely, if ever, hear about methods to embrace Pareto; ie selling covered calls, buying puts, or selling short when markets turn.

Nobel Laureate Paul A. Samuelson made a profound comment when he said: "The longer you own stocks, the greater risk of a devastating loss." Think about that for a moment. As investors gradually build a portfolio over time it generally goes up in total value. Meaning, just at the point of retirement a portfolio is the most susceptible to a sneaker wave. Look at the historical performance of the S&P 500:

For those visual learners out there like me, it is apparent that sneaker waves roll in often enough to really put the hurt on a long-term portfolio and potentially destroy decades of wealth. How often are these sneaker waves rolling in? You guested it, about 20% of the time. Meaning you can be cruising along on your yacht 80% of the time with the wind at your back, sun shining, and boom! A sneaker wave strikes.

How do investors embrace Pareto? First, investors need to accept that sneaker waves exist. For some reason Big Finance is obsessed with telling investors that they should only buy, buy, buy. I wonder why that is? Hmmm. Second, investors should build an "all-weather" strategy. This might be as simple as selling when the tide turns. Or it might be an aggressive approach like riding the wave, see Absolute Alpha. Third, investors should codify their strategy and monitor it.

Blindly dumping money into Index Funds and ETFs has been the hallmark pitch of Big Finance now for decades. Low cost! Low cost! chimes the jingle over and over like Chinese water torture. And as the billionaire heirs and executives of these juggernauts motor by in their cash-burning steamboats, who's advising investors to embrace Pareto? ILAF, that's who!