Heat Waves

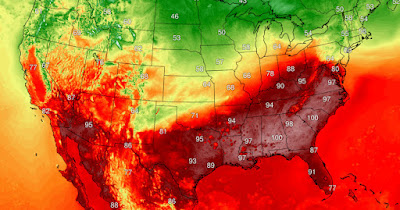

It is said that farmers live and die by the weather, so too with financial farmers. Particular amongst weather events are heat waves. These heat inductions outside nominal weather conditions typically have rapid onsets. We know they're coming, but not necessarily the time or place. So too with Bear Markets. A confluence of events result in both; for farmers a heat wave can lay waste to their crops and livestock; for those of us farming for profits and cash flow, a Bear Market can do the same to our portfolios.

World War Z has one of my favorite lines: "First to know, first to act." It relates to the measures North Korea took to prevent the spread of the Solanum virus. It is application to both farmers and financial farmers is immense. In terms of farmers and ranchers, knowing weather patterns allows them to prepare (somewhat) for conditions on their farms and ranches. Sadly, most are held hostage to the weather they get. There is a limit to the actions that can be taken; increase the watering, provide shade perhaps, and maybe move the herd. The investor, however, has multiple choices when a heat wave is imminent.

As discussed in a previous post, financial farmers have the ability to pursue an Absolute Alpha approach. This strategy harnesses early warnings systems to alert an investor to changing economic conditions. But just like heat waves and meteorology, the time and place of a Bear Market aren't precisely known to economists. Say hello to our old friend Pareto.

Pareto's Principle states that 80% of most results are directly proportional to 20% of the inputs. For our purposes we are keen to know where we are in an economic cycle and the corresponding stock market rotation (Bull/Bear). Why? Unlike farmers and ranchers beholden to heat waves, investors have the opportunity to take drastic, immediate action to protect their portfolios.

Being on the right side of a trade is vital; stay too long on the wrong side of a trade and you risk serious financial pain that may not be recoverable in the short term (or long term.) Also, being on the wrong side of a trade naturally implies you are NOT on the right side of the trade...hence the opportunity cost of a being on the upside. Farmers, ranchers, and investors all know time is a valuable commodity. Maybe the most valuable. And generally speaking, being wrong for extended periods of time is bad for business.