Bear Market Hell

Today marks the beginning of the Bear Market Hell. Although this country has endured much over the past 2 years, today we are embarking on something totally new...and painful. What was once the land of milk and honey has become one of soaring inflation, government disfunction, and most sadly the killing of thousands of innocent Ukrainian lives as we are on the cusp of WWIII. In the shadows lurks the bear.

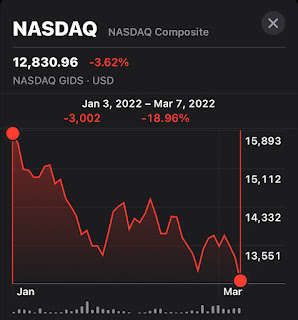

A bear market is historically defined as a 20% or more fall from the market's highs, and in this instance we are refereeing the all-important NASDAQ market which has become the barometer for world innovation and advancement. It has badly stubbled, and we are now in a full-on Bear Market.

Bear Markets are brutal for investors who own long position in stocks because the equity in many ways becomes a value trap, ie the asset withers away on a daily basis, even though it might be supported by reasonable price-to-earnings ratios, a solid dividend, and a leading market position none of that really matters in a Bear Market. The only thing that matters in a Bear Market is survival. Fear is everywhere.

Assume we'll be in the bear's dark cave for some time, as there is no end in sight for the current fiscal policy, energy regulations, or leadership failures. We're stuck. Investors with long-term views, think decades, can find increasingly good deals out there. In fact, those old curmudgeons Warren Buffett and Charlie Munger LOVE the opportunities a Bear Market presents; much suffering, plenty of misery, and a huge serving of stocks-on-the-cheap. They feast fear.

What to do, what to do? With little hope on the economic policy front, little chance of domestic energy being reignited, and a war looking more like a siege, investors need to be wary of committing assets. Cash has become king again, and investors can survey the field of battle for carrion like vultures for purchases.

It is hard to believe we're not headed for a recession now. The benchmarks have spoken their truth, and investors are finally listening. "Nature, time, and patience are the great healers," but hopefully voters are the fourth great healer this November.

Financial farmers need to be patient here. Long-term capital can be deployed with care on great brands broken low. Stagflation has also risen its ugly head, so beware of companies that can't (or won't) pass along price increases. We may have 8 months of pain ahead with markets whipsawing back-and-forth until new leadership takes power. Until then, a siege mentality is appropriate (and warranted.)